2021-03-31

ETH vs USD

ETHEREUM HAS BEEN FORMING A BEARISH DEEP CRAB. ABOVE 1920 TH MAGNET MOVE WILL TRIGGER UNTIL THE COMPLETION OF THE PATTERN IN 2375-2425 ZONE

U CAN GET LONG ON THE BREAKOUT OF 1920 UNTIL 2375-2425 RANGE OR THIS OPPORTUNITY COULD EXTEND TO THE COMPEMENTRY TOLERNCE MEASURE(1.902XA) AT 2625

AS ASIDE NOTE: THE 1.902XA IS AN ADDITIONAL MEASUREMENT IT WORKS EXTERMERLY WELL IN EXTENSION PATTERNS LIKE CRABAND DEEP CRAB THAT EXPERIENCED STRONG PRICE ACTION AT COMPLETION POINT

2021-03-30

GOLD

IN THE NAME OF ALLAH THE MOST GRACIOUS THE MOST MERCIFUL

FUNDAMENTALLY, U COULD SAY THE DOLLAR AFTER SHATERED ITS KEY 93 CEILLING , RISING TREASURY YIELDS TO 1.77% OR A COMBINATION OF AN ACCELERATING VACCINE ROLLOUT PROGRAM AND THE PROSPECT OF AN ADDITIONAL $3- $4 TRILLION IN INFTASTRUCTURE SPENDING, ALL OF THESE FACTORS ARE PILLING FRESH PRESSURE ON GOLD, OKAY.... GOOD! ALL OF WHICH SOUNDS REASONABLE

"BUT TECHNICALLY DON‘T FORGET WHAT IS SO CALLED :"THE PATTERN

FROM THE ELLIOTT WAVE PRINCIPLE (EWP) PERSPECTIVE PATTERN IS A WAVE

THE PATTERN SHOULD BE COPMPLETED TO GET THE TREND TURNS

HERE! GOLD IS NOT FINISHED YET THE MINOR FOURTH WAVE WHICH IS STILL UNFOLDING IN DOUBLE ZIGZAG PATERN THAT MAY COMPLETE IN $1640-$1600 RANGE

(C OF Y WAVE OF DOUBLE ZIGZAG IS STILL IN OPERATION)

BE SURE THAT ,WHEN THE WAVE IS COMPLETE, REVERSAL WILL OCCURE

(WAVES OF INVESTORE PYSCHOLOGY DRIVE MARKET PRICES)

2021-03-29

2021-03-27

NZD vs USD

THE NEW ZEALAND DOLLAR HAS ANCHORED ON THE INVERTED HEAD AND SHOULDERS PATTERN TO CHANGE ITS DIRECTION FROM BEARISH TO BULLISH, BUT LATELY IT SEEMS THAT THE FIRST WAVE IN THE UPTREND HAS ENDED,AND THE SELLING HEAD AND SHOULDERS APPEARED, THE PATTERN WAS A VALID ONE WHEN PARICES CLOSED BELOW 0.71 TO DOWNSIDE TARGET AT 0.67

NOTE, THE INVERTED HEAD AND SHOULDERS AND THE HEAD AND SHOULDERS ARE THE SAME AS THE PRICE MIRRORS (I DONT MEAN SIZE HERE ! BUT THE CONCEPT)

2021-03-26

2021-03-25

2021-03-24

EGX 70 EWI

,WE HAVE MORE THAN ARGUMENT THAT THE EGX 70 EWI HAS COMPLETED THE FIVE WAVES UP RALLY, AND CORRECTION HAS BEEN TAKING PLACE

FROM EWP PERSPECTIVE, THE LAST WAVE WAS UNABLE TO REACH THE UPPER TRENDLINE OF THE UP CHANNEL,(THE FIFTH WAVE) , A DECISIVE BREAK IN THE RISING CHANNEL , AND THE IMPULSIVE NATURE OF THE DECLINE SUGGEST THAT A MAJOR TOP IS IN PLACE , FINALLY THE CLASSIC NEGATIVE DIVERGENCE ON THE MACD CONFIRMED THIS COUNT A LONG THE WAY ( DIVERGENCE OFTEN OCCURES BETWEEN THE THIRD AND THE FIFTH WAVE IN ACTIONARY WAVES)

SO ,MORE LIKELY EGX 70 EWI IS CORRECTING WAVE 2, THAT MAY TAKE PRICES INTO DEEP CORRECTION THAT TEND TO MORE OFTEN TO RETRACE 50% OR 61.8% OF THE REVIOUS WAVE (FROM MARCH LOWS TO RECENT HIGH AT 2472)

I DO THINK IN THE COMING DAYS , EGX70 WILL PULLBAC(PROBABLY AFTER PRICE TOUCH 1760) IN A CORRECTIVE MOVE TO HIT 2000-2250 RANGE, BEFORE RESUMING THE DOWNTREND TO REACH THE 1450-1650 ZONE

2021-03-23

2021-03-22

2021-03-19

CRUDE OIL

A DECISIVE BREAK IN THE UPTREND LINE , AND THE IMPULSIVE NATURE OF THE DECLINE SUGGEST THAT A MAJOR TOP IS IN PLACE

IF MY COUNT IS CORRECT, 2ND WAVE OFTEN RETRACE ABOUT 50%-62% OF WAVE ONE

SO THE TRENDLINE MIRRORS( AFTER TRENDLINE IS BROKEN, PRICES WILL USUALL MOVE A DISTANCE BEYOND THE TRENDLINE EQUAL TO THE VERTICAL DISTANCE THAT PRICES A CHIEVED ON THE OTHER SIDE OF THE LINE) GIVE US A DOWNWARD TARGET AT $51.5 THAT‘S CORRESPONDING WITH ROUGHLY 50% OF WAVE ONE (PRIOR UPTREND)

NOTE THE PULLBACK ON THE BROKEN TRENDLINE IS WAVE FOUR

2021-03-16

2021-03-15

2021-03-13

RUSSELL 2000

SMALL CAPS THAT ARE INCLUDED IN THE RUSSELL 2000 INDEX HAVE RISEN 54% SINCE NOV2020 LOWS -TO HIGHEST HIGH ,WHILE THE BIG CAPS IN S&P 500 , NDX100 GAINED 22.5% AND 25.2% RESPECTIVELY

NOTE THE HIDDEN DIVERGENCE BETWEEN THE LAST 3 RISING VALLEYS AND THE RSI INDICATOR

2021-03-12

2021-03-11

SPREAD BETWEEN US AND GERMAN BOND YIELDS WIDENED

SPREAD BTWEEN US AND GERMAN BOND YIELDS WIDENED

ON ONE HAND SEARCH ABOUT STIMULUS PACKAGES WHICH LED TO INCREASE THE SUPPLY OF BOND,THUS INCREASE IN THEIR YIELDS

ON TH OTHER HAND GERMANY‘S BOND WHERE THE SUPPLY HAS BEEN LOW IN RECENT YEARS OF BUDGET SURPLUS ALONGSIDE BUYING BY THE ECB FOR QUANTITATIVE EASING MEANS THERE ARE LONG TERM STRUCTURAL FACTORS PUSHING YIELDS LOWER

TESLA STOCK

THE DECLINE FROM $900 TO $538 IN IMPLUSIVE MANNER PROVES THAT THE PEAK IS IN PLACE, AND THE FIREST LEG OF CORRECTION ALSO HAS COMPLETED IN TESLA. THE REBOUND SHOULD BE IN THREE MOVES AND MOSTLY WILL HIT $760(61.8% OF A) AS A COMMON RETRACEMENT , MOST OF THE TIME WAVE B RETRACES 38.2%-78.6% OF WAVE A, IT DEPENDS UPON THE STRUCTURE OF WAVE B( IF WAVE B IS ITSELF A ZIGZAG IT RETRACES 50% -78.6% OR IF IT IS A TRIANGLE IT RETRACES 38.2% -50%, HOWEVER AS I SAID BEFORE THE LEVEL OF 500 SHOULD BE BROKEN

NOTE: $360,$410, $435 ARE THE MOST LIKELY NUMBERS COULD TESLA REACH TO ONE OF THEM IN CASE OF WAVE C= WAVE A (THE MOST COMMON FIBONACCI RELATIONSHIP IN SINGLE ZIGZAG) EQUILTY IN LENGTH

ALSO NOTE THE PRIMARY GUIDELINE ACCORDING TO ELLIOTT WAVE THEORY WHEN CORRECTION IS ITSELF FOURTH WAVE IT WOULD REACH THE ZONE OF WAVE FOUR WITHIN WAVE THREE (LOOK AT THE TRIANGLE THAT I POINTED OUT IT , THAT IS THE SUPPORT AREA WHERE CORRECTION MAY END THERE

2021-03-10

BTC vs USD

BITCOIN SINCE LOW OF $43400 HAS BEEN RISING QUIETLY AND WITOUT ATTRACTING MEDIA ATTENTION, I THINK MAY BITCOIN‘S VOLATILITY BE STARTED TO EBB

BUT SO FAR BITCOIN IS PROGRESSING IN A CORRECTIVE RALLY(3 MOVES UP), WHICH MAKES ME DOUBT THAT WE‘RE FORMING A TRIANGLE OR SO AND THE FOURTH WAVE STILL ONGOING, INVERTED HEAD AND SHOULDESRS IN THAT CASE IS NOT ENOUGH

WE NEED IMPULSIVE MOVE TO THE UPSIDE TO SAY THE BOTTOM IS IN PLACE

IF PRICES BREAK DOWN $43400 THE SCOND LEG OF GRRECTION MAY HAVE BOTTOED IN

$42000- $29000 ZONE

THE NEXT UPSIDE TARGET AT $57000 AS LONG AS $43400 IS NOT BROKEN

2021-03-09

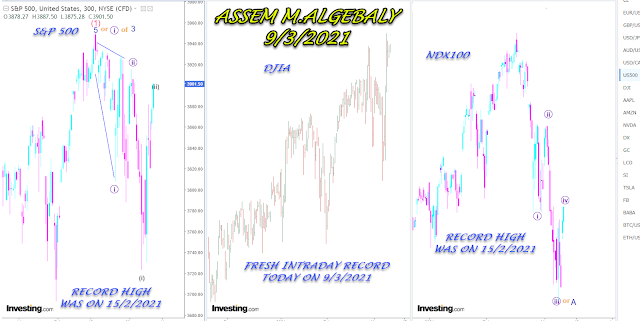

THE TRENDS IN THE THREE KEY US INDICES

THE TRENDS IN THE THREE MAIN US STOCK INDEXES HAVE DIVERGED IN LAST 3 WEEKS, THE DJIA IS AT NEW HIGHS,ON THE CONTRARY S&P 500 AND NDX100 HAVE BEEN DECLINING SINCE A BOUT MID- FEBRUARY

IN SUCH CASES, TRENDS MAY NOT BE HEALTHY IN BULL MARKET AND SUGGEST A NARROWING OF THE ADVANCE

BE ALRET

2021-03-08

2021-03-06

Subscribe to:

Comments (Atom)