2021-10-30

USD vs TRY

AS SHOWN AS IN THE SECOND CHART WE ANTICIPATED THE TURKISH LIRA WILL SUFFER A DECLINE AGAINST THE DOLLAR, AND THE UPSIDE TARGET IN RANGE . OF 9.35-9.65..... TARGET DONE

AND PRICE COULD EXTEND UP TO 10.15 AT 1.92 XA OF BEARISH CRAB PATTERN

IF U SHORT THE TRUKISH LIRA , PUT UR STOP LOSS A PENNY ABOVE 9.86

2021-10-29

REAL CONSUMER SPENDING

This time is different! After 2008, real consumer spending in the US never made it back to its pre-crisis trend, due to insufficient policy stimulus. Not true now. Real consumer spending as of Q3 2021 is already back to its pre-COVID trend. There is NO output gap in the US.

2021-10-28

2021-10-27

CRB COMOMDITY INDEX

IN THE NAME OF ALLAH THE MOST GRACIOUS THE MOST MERCIFUL

THE CRB INDEX REPRESNTS A BASKET OF COMMODITIES AS IT IS FORMALLY IS COMPRISED OF 19 COMMODITIES ISSUED IN THE SECOND PICTURE. THE 19 COMPONENTS EACH CARY A DIFFERENT WEIGHT. CRUDE OIL BEING THE HEAVIEST (23%) , THAT CLARIFY WHY OIL AND CRB INDEX WERE AT ALL TIME HIGHS IN JULY 2008. THE FIRST CHART WE‘RE LOOKING AT IS A LONGER TERM VIEW OF THE CRB INDEX THROUGH THE EWP PERSPECTIVE(A LITTLE MORE THAN 90 YEARS, SINCE 1930 ). THIS VIEW SUGGESTS THAT THE CRB INDEX PEAKED IN JULY 2008 AT 474 AS A SUPERCYCLE WAVE ONE THEN , THE MASSIVE DECLINE WAS A SUPERCYCLE 2 COMPLETED AT MARCH LOWS 2020 AT 101. SO THE THIRD WAVE AS KNOWN IS THE MOST POEWERFULL WAVE IS IN PROGESSING , AND SHOULD EXTEND PRICES HIGHER ABOVE THE OLD PEAK 474. THE RECENT RALLY IN FIVE WAVES UP WITH THE BULLISH DIVERGENCE ARE CONFIRMED THAT THE LOW IS IN PLACE. STUDY OF CRB INDEX TELL US A LOT ABOUT GLOBAL DEMAND AND CAN HELP US MAKE DECISIONS IN OUR EVERY DAY TRADING. NOT ONLY THAT, AS LONG AS CRB INDEX REMAINS ELEVATED INFLATION IS NOT GOING AWAY ANYTIME SOON , THAT WILL DEFINITELY AFFECT BASIC NECESSITIES (LIKE OIL, NATGAS,CORN....) AND PRIME COMMODITIES(LIKE COTTON, SUGAR, WHEAT, COPPER,....) (INFLATIONARY PRESSURES)

NOTE: I ALWAYS SAY , THAT ANY DIVERGENCE WETHER A NORMAL DIVERGENCE OR REVERSE DIVERGENCE NEEDS TO BE CONFIRMED IN ONE OF THE WAYS I MENTIONED EARLIER, HERE A NORMAL BULLISH DIVERGENCE WAS CONFIRMED BY CLOSING THE 40-WEEK MOVING AVERAGE

2021-10-26

2021-10-25

2021-10-23

2021-10-22

BTC vs USD

BITCOIN AFTER HAS BEEN FOUND ITS BOTTOM AT 28600 BOUNCED BACK IN FIVE WAVES UP RALLY, JUST HAS FINISHED 2 WAVES AND NOW THIRD WAVE IS UNDERWAY, IT IS CLEAR THAT THIS WAVE DIVIDED INTO 5 WAVES AT THE LOWER DGREE, AND WE BELEIVE - ACCORDING TO OUR INTERPRETATION-THAT BITCOIN SPECIFICALLY IS IN THE MINUTTE SECOND WAVE (GRAY COLOR) THAT MAY REACH A RANGE OF 50000-52500 (LOOK AT THE AB=CD HARMONIC PATTERN IS COFIRMED THAT COUNT), THEN AFTER WAVE TWO CORRECTION IS COMPLETE WE LOOK TOWARD THE COMPLETION OF THE CRAB PATTEN IN A RANGE OF 87350-88000

BUT NOTE , CRAB PATTERN MOSTLY EXPERIENCED STRONG PRICE ACTION AT COMPLETION POINT, FURTHERMORE BITCOIN IN WAVE THREE , THAT THE MOST POWERFULL WAVE EVER, SO I DO THINK BITCOIN HAS ROOM FOR SOME FURTHER RALLY EVEN BEYOND 88000 LEVELS

2021-10-21

2021-10-20

CAPITAL EXPENDITURE

CAPEX REVIVAL? The mining industry was first in slashing capex, well ahead the oil industry. But now at least one major miner, , is flagging rising capex, which could hit $10bn in 2024, nearly double from 2018. The increase comes amid high copper and iron ore prices

2021-10-19

S&P 500

ON THE CHART , CONSOLIDATION INVERTED HEAD AND SHOULDERS APPEARS, PRICES IS VERY NEAR FROM THE ALL TIME HIGH AT 4545, THAT MIGHTBE A FIRST HURDLE IN CONTINUATION OF STEADY ASCENT TO MAKE A NEW ALL TIME HIGHS

NOTE: THAT THE COMPLETION OF THE CONSOLIDATION HEAD AND SHOULDERS CONFIRMED THE BULLISH CLASSIC DIVERGENCE

2021-10-18

GOLD

WHEN WILL GOLD SHINE AGAIN ?

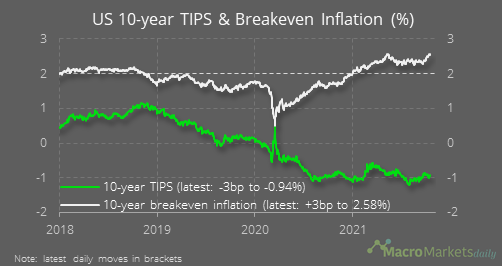

FUNDEMENTALLY SPEAKING:- INVESTORS FOUCS ON NUMERUOS FACTORS THAT DRIVE THE PRICE OF GOLD. LIKE SUPPLY AND DEMAND,UNCERTAINTY IN THE MARKET, AND ONE OF THE LESS OBVIOUS BUT SEEMS TO HAVE MORE PREDICTIVE POWER OVER THE LAST DECADES IS REAL YIELDS( U.S.INTEREST RATE MINUSE ANNUALIZED CONSUMER PRICE GROWTH). AS THE REAL YIELD DECLINES GOLD OFTEN RALLIES , AND WHEN THE REAL YIELD GOES NEGATIVE GOLD BECOME VERY EXCITED. LOOK AT THE DIAGRAM NO (1) IT SHOWS THE PRICE OF GOLD VERSUS THE US REAL YIELD AS MEASURED BY THE 3 MONTH TREASURY BILL RATE MINUS THE ANNUALIZED GROWTH RATE IN THE CONSUMER PRICE INDEX . WE CAN SEE THAT WHEN THE REAL YIELD IS NEGATIVE AND STILL DECLINING, THE PRICE OF GOLD HAS

TENDED TO RALLY, BUT LOOK WHAT HAS HAPPEND WHEN THE REAL YIELD HAS DROPPED BELOW MINUS 3% AND THE EXTREM LOW HAS COINCIDED MOR OR LESS WITH A PEAK IN THE GOLD PRICE AS THE 2011-2012 PERIOD WHEN REAL YIELD WENT BELOW -3% PUSHING PRICE OF GOLD INTO THE $1800 RANGE

BUT AT EXTREEM NEGATIVE LOW LIKE -5% OR MORE THE PROBABILITY IS HIGH THAT A LOW IN REAL YIELD IS NOT TOO FAR AWAY. THE GOLD PRICE HAS ALREADY BEEN DECLLINING , PERHAPS ANTICIPATING A MOVE BACK UP IN THE REAL YIELD, THAT MOVE COULD COME ABOUT BY AGGERSSIVE FED TIGHTENING MONETARY POLICY AMID SOLID RISES IN COMSUMER PRICES INDEX AND SUPPLY CHAIN DISRUPTIONS

TECHNICALLY SPEAKING : OUR MAIN COUNT SUGGESTING THAT WAVE (3) IN GOLD APPEARS TO HAVE PEAKED AT $2075 HIGH, THEN WE ARE ALLOWING FOR TRAINGLE TO UNFOLD AS WAVE (4) .COMPLETING THE TRIANGLE INDICATES A THRUST HIGHER IN FIVE WAVES FOR WAVE (5) TO MAKE ANOTHER ALL TIME HIGH ABOVE $2075 .

BEARISH ALTERNATE ,WILL TAKE PLACE WHEN PRICE BREAK BELOW THE CRUCIAL SUPPORT AT $1680

2021-10-15

US JOBLESS

US initial jobless claims fell below the 300K threshold (293K) for the first time since the #Covid crisis

2021-10-14

ETH vs USD

ETHEREUM AFTER HIT THE 4000 LEVEL FORMED A CONSOLIDATION HEAD AND SHOULDERS , WHEN PRICE CLOSED ABOVE 3700 IT CONFIRMED THE PATTERN AS VALID ONE , UPWARD TRAGET AROUND 4700 , BUT KEEP A CLOSE EYE ON 4000 THE OVERHEAD RESISTANCE OR THE CURCIAL RESISTANCE

2021-10-13

DOW JONES

DOW JONES ON 4 H , AND OUR PRIMARY COUNT SUGGESTS THAT THE INDEX IN FIVE WAVES DOWN DECLINE AS THE FIRST LEG OF CORRECTION ,CPECIFICALLY IN MINUTE FOURTH WAVE THAT IS LIKELY CONSOLDITATES AS A TRAINGLE THEN ONE MORE PUSH DOWN TO COMPLETE THE FIRST LEG , MORE LIKELY AT 33200

ALTERNATIVELY, FIRST LEG OF CORRECTION ENDED AT 33600 AS A LEADING DIAGONAL AND MORE SIDEWAYS AS A COUNTER TREND BEFORE THE SECOND LEG OF CORRECTION WHICH WILL NOT FAR AWAY FROM THE ABOVE METINOED OBECTIVE AT 33200

2021-10-12

US10Y-YIELD

US 10y YIELD FORMED A DISTINCT BEARISH DEEP GARTLEY, THE COPMLETION POINT OF THE PATTERN AT 1.773, AFTER AN IDEAL REVERSAL, THE FIRST DOWNSIDE TARGET AT 0.382 AT 1.220 IS DONE AND PRICE BOUNCED OFF TO UPSIDE , NEAR THE PRIOR HIGH.

BEAR IN MIND THE CHOPPY MOVE BETWEEN1.220-1.776 MIGHT THE FIRST SIGNS OF THE PATTERN‘S FAILURE

2021-10-11

SILVER

, SILVER FORMED A CLISSICAL CHART PATTERN ,I DO THINK NO MATTER WHAT ITS NAME IS.IF IT IS A TIRPPLE TOP OR A RECTANGLE, THE TWO PATTERNS IN THIS CASE WILL PERFORM THE SAME FUNCTION, WHICH IS REVERSE THE UPTREND TO THE DOWN TREND WHEN A PTTERN CLOSE BELOW THE $22 LEVEL, IT COULD HIT IN THIS CASE THE $17 LEVEL

2021-10-09

S&P 500 vs STAFLATION

This chart by Goldman helps explain why investors are afraid of stagflation. During the last 60 yrs, S&P 500 has generated a median real total return of +2.5% per quarter, but that quarterly return fell to -2.1% in stagflationary environments.

2021-10-08

Subscribe to:

Posts (Atom)