2021-12-31

EUR vs USD

I MENTIONED EARLIER , THAT THE ADVANCE FROM LAST MARCH LOW AT 1.0635 TO JAN 2021 HIGH AT 1.2349 WAS A FIVE WAVES UP RALLY AS WAVE (1) OR (A), SINCE THEN CORRECTION HAS BEEN TAKING PLACE AS WAVE (2) OR (B).

AS WE CAN SEE THE CORRECTIVE WAVE MOSTLY LIKE A ZIGZAG PATTERN , AND THE THIRD WAVE IS STILL IN PROGRESSING, MIGHTBE HIT AT LEAST 1.1090 LOW

I DO THINK THE FOURTH SUBWAVE (ORANGE) OF THE THIRD(CIRCLE GRAY) WILL NOT OVERLAP WITH THE 1.1524, OTHERWISE THIS SCENARIO WILL BE NAGATED, BUT I DO THINK THE MOST LIKELY FOURTH SUBWAVE WILL BE A TRIANGLE AND THE WHOLE CORRECTION IS COMPLETE AT 1.0820. MOREOVER THE BULLISH ALTERNATE BAT PATTERN WHICH IS COMPLETE AT 1.0820 BOLSTERS THE IDEA, THAT THE CORRECTION WILL END THERE

EVENTUALLY DONT FORGET , THE SECOND WAVE WHEN IS ITSELF A ZIGZAG PATTERN MOVE DOWN INTO THE AREA OF THE SECOND WAVE OF LESSER DEGREE(LOOK AT THE RANGE OF 1.0776-1.1144 INTO THE CIRCLE ON THE LEFT SIDE AT THE BOTTOM OF THE CHART

2021-12-30

USD vs TRY (EWP PERSPECTIVE)

REGARDLESS OF EROGAN‘S DECISIONS , AND WHETHER UR ONE OF HIS SUPPORTERS OR CRITICS, BUT HERE OUR INTERPRETATION IS BASED ON THE BASSIC PRICIPLES OF TECHNICAL ANALYSIS ONLY. FROM MY EWP PERSPECTIVE I CAN SAY THAT THE USD/TRY ENDED ITS LONG TERM UPTREND AT 18.6 AS A PRIMARY SCENARIO, SO THE RECENT DECLINE IN FIVE WAVES DOWN WAS THE FIRST LEG OF THE CORRECTION AND THAT SUGGESTS THE CORRECTIVE MANNER WILL BE ZIGZAG WAVE (5-3-5) AND JUST FINISHED THE FIRST SEGMENT ONLY AS WAVE A (CIRCLE IN RED) FOLLOWED BY A TEMPORARY BOUNCE TO 13.5 OR 15 THEN ANOTHER MOVE DOWN TO POSSIBALE TARGET AT 7.25 OR AT 5

SOME MAY DISAGREE WITH ME ABOUT EXTREM MOMONETUM AND VOLUME AND ARGUE , THAT THE USD/TRY IS IN THIRD OF THIRD THAT THE STRONGEST WAVE EVER IN AN IMPLUSIVE ADVANCE, THIS IS A CONSIDERING OPINOIN ,AND I PUT IT AS ALTERNATIVE COUNT, BECAUSE I SATED EALIER THAT THE WAVE WIL BE A ZIGZAG PATTERN I MEAN THAT IS NOT COMPLETE YET , AND LOOK AT THE FIRST LEG RETRACED OUT MORE THAN 61.8% OF THE PRIOR WAVE(8.27-18.60) OR EVEN WE ASSUMED THAT THE WAVE STARTED AT 5.12, IT SHOULD IN BOTH CASES OVERLAPING WILL OCCURE BETWEEN THE FOURTH WAVE (CURRENT DECLINE) AND THE WAVE ONE REGARDLESS OF WETHER THE TOP OF WAVE ONE AT 8.82 OR AT 8.60 ACCORDING TO THE BEST COUNT

BUT MY LOGICAL INTERPRETATION FOR THE CASE OF HIGH MOMENTUM AND HIGH VOLUME THAT THE FIFTH WAVE IN THE HIGHER DEGREES OF IMPLUSIVE ADVANCE (ABOVE INTERMEDIATE DEGREE) CONTAINS A LARGE AMOUNT OF SPCULATIONS, IN ADDITION TO THE FACT THAT MOST OF THE HERD ENTERS UNCONSCIOULY AT THIS POINT TO MAKE UP FOR WHAT THEY MISSED(FOMO), RESULTING IN A SURGE IN VOLUME AND MOMENTUM

2021-12-29

COMMODITIES vs EQUIITY RATIO

The commodities-to-equity ratio is now at even lower levels than at other times when we experienced other major macro regime changes, such as the early 1970s and 2000s.

Both times we had the stock market trading at excessive valuations while commodities were at depressed levels

2021-12-28

BTC vs USD

BITCOIND FORMED A DISTINCT BULLISH SHARK PATTERN , THE 1.618 OF AB COMPLETION BEFORE THE 88.6% OF 0X INDICATES THAT THE BULLISH SHARK IS COMPLETE AT THE 88.6% OF 0B(42100), U CAN TAKE UR INITIAL PROFIT TARGET AT 55000

NOTICE, THAT THE BULLISH SHARK COULD MORPH INTO A BEARISH THE 0-5 PATTERN. IF THAT THE CASE, ANTICIPATE THE DOWNWARD TREND WILL CONTINUE ESPECIALLY AFTER BREAKING DOWN THE 42000 LEVEL

2021-12-27

2021-12-24

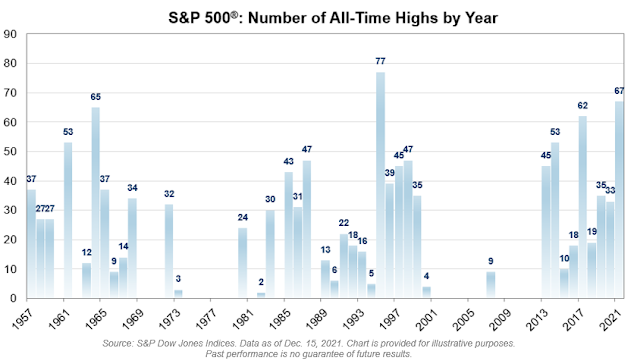

S&P 500 SEASONALITY

2021 was a very good year for $SPX Seasonality Tracking: set a mid-Oct low, Oct Surge, early November pullback, then final melt-up starting mid-Dec. Last phase now. If it continues tracking, this buy dips rally goes until Jan 10-15

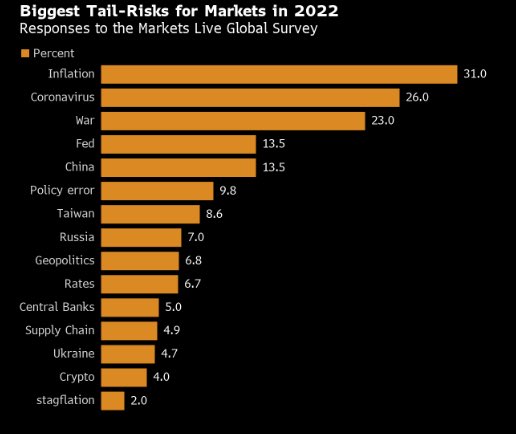

FAT TAIL RISKS FOR MARKETS IN 2022

The truth is that Wall Street and the investment crowd are always looking in the rear view mirror.

While I agree that inflation is here to stay, that’s not the biggest tail-risk for 2022.

It’s this frothy equity market as Fed takes the liquidity punch bowl away

2021-12-23

2021-12-22

APPLE

APPLE BOUNCED BACK AFTER TOUCHED THE UPPER TRENDLINE OF THE RISING CHANNEL , BUT I THINK ITS A TRASITORY BOUNCE AND THE SIDEWAYS MOVEMENT PROBABLY IS THE DOMINANT UNTIL BREAKOUT THE HIGH OF $182

AND IF THAT‘S NOT THE CASE , THE RANGE OF 157--158 IS THE NEXT DOWNSIDE TARGET (CRUCIAL SUPPORT ZONE)

2021-12-21

CRUDE OIL

AS I SAID ON 29/11/2021(U CAN REVIEW THAT IPMORTANT POST), HOWERVER OIL IN BOUNCE PHASE MAY BE FORMING A TRIANGLE THEN ONE MORE PUSH DOWN TO COPLETE THE SECOND WAVE CORRECTION , AND WE HAVE A HEAH AND SHOULDERS COMPLEX HEADS . WHEN BE A VALID ONE ,IT CONFIRMS THE EALIER TARGET AT $45 AND COULD REACH TO $40

ANY WAY 40-50 RANGE DESERVE WACHING CAREFULLY, AND IF PRICE DOES NOT BREAK 62 THIS SCENARIO IS NAGATED

2021-12-20

2021-12-18

WORLD ARABIC LANGUAGE DAY

ON THE WORLD ARABIC LANGUAGE DAY WE SURVEY SOME FACTS ABOUT ARABIC LANGUAGE LIKE.

- THERE ARE HALF A BILION PEOPLE WHO SPEAK ARABIC AROUND THE WORLD AND THEY MAK UP 6.6% OF THE WORLD POPULATION

- MOST WORDS IN THE ARAEBIC LANGUAGE ARE DERIVED FROM A ROOT, THERE ARE BTWEEN5000 AND 6500 LEXICAL ROOTS IN ARABIC,AND THE NUMBER OF WORDS CONTAINED IN ARABIC LANGUAGE IS ABOUT 12 MILLION WORDS

- THERE ARE ABOUT 26 COUNTRIES THAT CLAIM ARABIC AS AN OFFICIAL OR CO OFFICIAL LANGUAGE

- ARABIC IS THE ONLY LANGUAGE IS WRITTEN FROM RIGHT TO LEFT

- ITS THE 6th LARGEST LANGUAGE IN THE WORLD

- FINALLY ITS THE NATIVE LANGUAGE OF THE HOLLY QURAN OF MUSLIMS, AND MUSLIM‘S PRAYER IS NOT VALID UNLESS THE QURAN IS RECITED IN ARABIC

2021-12-17

2021-12-16

KING DOLLAR

The dollar is poised for its biggest annual gain in six years. Investors are betting the currency will continue to strengthen, with positioning in the currency turning the most bullish since 2015

BULL MARKET IN BASE METALS IS ALREADY UNDERWAY

NOTICE THE POSITIVE CORRELATION BETWEEN COPPER&THE DB BASE METALS FUND, HOWEVER, THIS RELATIONSHIP TELLS US A MASSIVE BULL MARKET IS ALREARDY UNDERWAY, WHICH MEANS THE BASE METALS LIKE COPPER ,NICKEL,ALUMIMNUM, AND ZINK ARE LIKELY WILL RISE

WE ANTICIPATED THE PRICES OF BASE METALS TO RISE BASED ON AN ELLIOTT CONTRACTING TRAINGLE IN BULL MARKET AND THE SHARP MOVE IN SOME TIMES THAT FOLLOWING THE TRIANGLE AND MAKE A NEW RECORD HIGH

2021-12-15

2021-12-14

USD vs TRY

WHT IS HAPPINING FOR TURISK LIRA?1

TURKEY‘S LIRA CRASHED TO A RECORD LOW OF 14.68 ON MONDAY, IM SURPRISING ABOUT THE INSANE MONETARY POICY THAT TURKY IS CURRENTLY OPEATING UNDER. HOW THE CENTRAL BANK CUTS RAT AMID RISING DOUBLE DIGIT INFLATION (NEAR 20%,) SINCE YEAR AGO LIRA HAS BEEN TRADING AT ROUGHLY 7.5 TO THE GREENBACK

I DO THINK WHEN WE LOOK AT THE CHART, THE PARPOLIC MOVE IS THE THIRD OF THIRD WITH THE HIGHEST MOMENTUM EVER , SUGGESTS THE LIRA COULD PULLBACL IN A SMALL CORRECTION MAY BE TO 12 THEN ANOTHER POTENTIAL UPSIDE MOVE TO 16

2021-12-13

SENTIMENT

The Fear & Greed Index stands at 38, signaling fear in the US stock market

https://isabelnet.com/?

ETH vs USD

ETHEREUM SEEMS TO BE FORMING A TRIABGLE , AND AFTER REACHING TO 4865 DECLINIG AS WAVE C OF TRAINGLE IN PLAY, WHEN IT COMPLETES AROUND 2900 ANOTHER PUSH UP AND FINALLY PUSH DOWN TO COMPLETE THE TRAINGLE THEN POST TRIANGLE MOVE IS SHARP AND MAKE A NEW ALL TIME HIGH ABOVE 4800

2021-12-11

2021-12-10

Subscribe to:

Comments (Atom)