2022-02-28

2022-02-25

GOLD

FINALLY GOLD PRICES WERE ABLE TO BREAK OUT OTH SIDEWAYS RANGE AND COMLETED THE TRIANGLE AS WAS PREVIOUSELY EXPECTED, AND THE EW COUNT ON THE CHART WAS MORE LIKELY BY BREACHING THE LEVELS OF 1877$ THEN 1909$

SO THE NEARTERM UPSIDE TARGET NOT ONLT THE OLD PEAK AT 2075$ BUT THE FURTHER TARGET COULD HIT 2200 OR MAY EXTEND TO 2300-2400 ZONE REGARDLESS ANY GEOPOLITICAL TENSIONS

BEAR IN MIND TO PUT THE STOP LOSS LIMIT AT 1877$ FOR THE SHORT TIME INVESTORS

AND IF PRICES BREAKDOWN 1680$ THE LONGTREM INVESTORS CALL THE STOP LOSS ORDER

2022-02-24

CRUDE OIL

CRUDE OILE HAS FORMED A BERAISH CRAB PATTERN , THE COMPLETION POINT OF THE PATTERN WAS 99.5 $, BUT PRICE COULD EXTEND TO 106 $ AS WE SPOKE EARLIER ABOUT THE EXTREMITY OF THIS STURUCTURE TYPE (CRAB, DEEP CRAB), SO IT IS COMMOMN TO OVSERVE EXTREM PRICE ACTION AS THE PATTERN COMPLETES , SO WE INCLUDE THE 1.902 XA MEASURE AS ADDITIONAL TOLERANCE LIMIT BEYOND THE1.618 XA

2022-02-23

2022-02-22

NUMBER OF STOCKS WITH MACD BUY SIGNAL

HALF of Nasdaq Stocks have triggered Buy signals – one of the strongest spikes of all time.

Spikes of this magnitude led to historic rallies in Stocks.

A textbook Bull Market response after a sentiment capitulation – follow the Trend

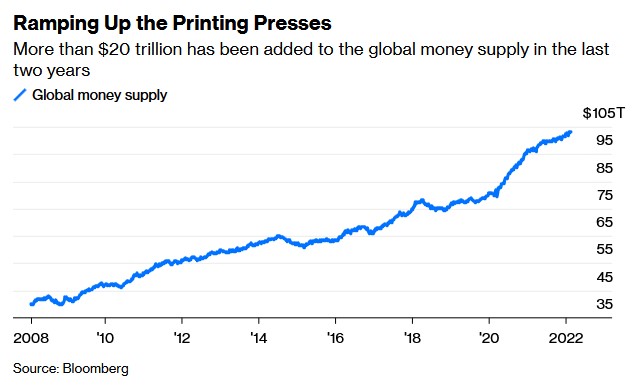

LIQUIDITY

IN THE NAME OF ALLAH THE MOST GRACIUOS THE MOST MERCIFUL

S&P 500 E-mini futures market liquidity remains below average levels

2022-02-21

2022-02-19

2022-02-18

2022-02-16

2022-02-15

SPX

Currently 45% of SPX names remain above their 200-day moving average. Going back to 2009, the major corrections have been marked by extended time below the 50% level for this indicator. Key chart to watch here.

2022-02-11

2022-02-09

FACEBOOK LOKKS LIKE FINISHED THE CORRECTION AS INTERMEDIATE WAVE TWO (2) AS A DOUBLE ZIGZAG (W-X-Y)

WACH CAREFULLY THE GAP , IF PRICE CLOSE IT , DURING THIS REBOUND IT BLOSTERS , THIS COUNT, BUT IF NOT THAT THE CASE , WE ARE IN IMPLUSIVE MANNER, SPECIFICALLY IN THIRD WAVE AND THE CORRECTION WILL DROP PRICED MORE DEEPER

2022-02-08

RETURN

Small cap stocks tend to underperfom the S&P 500 when growth slows

NIKKIE 225 INDEX

NIKKIE 225 INDEX HAS COMLETED A RECTANGEL TOP, AS WE KNOW THE UPWARD BREAKOUT IS 63% OF THE TIME , BUT HERE THE DOWNWARD BREAKOUT OCCURED

NOTICE THAT THE PARTIAL RISE WAS A GOOD SIGN FOR PRDICTING THE DOWNBREAKOUT ,HOWEVER THE DOWN WARD TARGET COULD HIT 23550

2022-02-07

APPLE vs ENERGY STOCKS

This is simply not normal.

Apple’s market cap is 40% larger than the entire energy sector.

Don’t tell me fundamentals justify this disparity.

Energy stocks generate almost 50% more in annual FCF than Apple.

Wait until oil prices break out above $100/bbl.

2022-02-05

Subscribe to:

Comments (Atom)