2022-03-31

CRUDE OIL

CRUDE OIL COMPLETED THE FIVE WAVES UP AS WAVE ONE ON THE HIGH DEGREE(PRIMARY DEGREE) THEN FALLING DOWN BELOW $100 TO MAKE THE FIRST LEG OF CORRECTION AS WAVE A OR ALTERNATIVELY WAVE ONE OF A OF WAVE 2,HOWEVER OIL IN A REBOUND PHASE THAT MAY BE CONSLIDATING SIDEWAYS AS A TRIANGLE , OR IT COMPLETED AT $116(BREAKDOWN 92 A BIG CLUE THAT WAVE B IS IN PLACE) THEN ONE MORE PUSH DOWN TO COMPLETE WAVE C OF WAVE 2 OR MORE SELLING PRESSURE AHEAD AS WAVE THREE OF A OF WAVE 2

SO WE ARE SHOWING THE PICTURE BEFORE SOME SAYIN THE BIDEN‘S ADMINISTRATION ANNOUNCED A RECORD RELEASE OF 1.0 MILLION BARRELS PER DAY FROM THE STRATEGIC PETROLEUM RESERVE OVER THE NEXT SIX MONTHS AND THIS IS WILL PULL CRUDE PRICES DOWN

NOTICE, THE DOWNSIDE TARGET COULD HIT $82 OR MAY EXTEND TO 71 OR 63

BUT IF CRUDE OIL JUST ONLY IN THE FIRST LEG OF CORRECTION ANTICIPATE MORE DECLINE AHEAD IN RANGE OF 67-55

2022-03-30

VALUE vs GROWTH

Growth stocks not buying 8 hikes this year

2022-03-29

BITCOIN

Bitcoin made a BULLISH cross on the weekly MACD

REAL FED FUNDS RATE

Stocks keep rallying because the Fed is still way behind the curve when it comes to inflation, allowing the economy to run hot: Credit Suisse's Jon Golub. "Not only is the rate too low today, but it will likely be too low even after the Fed completes its projected rate hikes.

2022-03-28

GOLD MINERS vs S&P 500

support keeps holding down there in Gold Miners on a relative basis

FINANCIAL STRESS

How long will the BofA global financial stress indicator remain high?

2022-03-26

S&P 500

Short-term investor overreactions tend to create opportunities in US stocks

COMMODITIES

How long can the commodities rally last?

2022-03-25

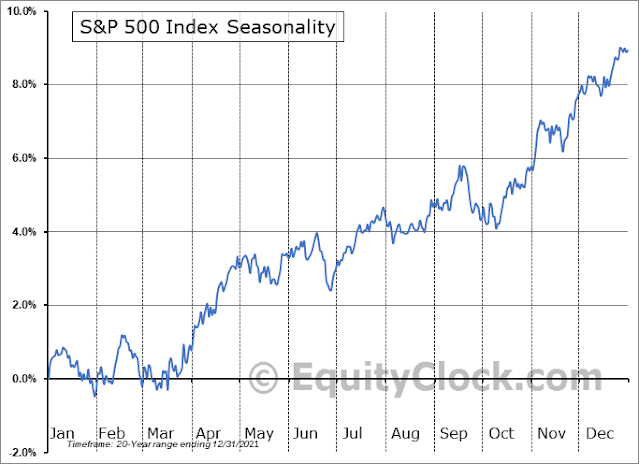

SEASONALITY

Seasonality continues to predict SPX's turn points with eerie precision: Late Feb low, early March bottoming process, mid-March lift off. What's next? If it continues: After some late March chop, April is a trend month & most bullish of the year, green 80% of the last 20 years

EGYPT‘S POUND

We flagged a 15% overvaluation of Egypt's Pound for the past year. This week's devaluation was about 15%, so is overvaluation over? Our 15% overvaluation number pre-dates Russia's invasion of Ukraine & the recent sharp rise in wheat prices. The Pound (pink) has further to fall.

RISK APPETITE INDICATOR

Risk appetite rebounded over the last few days with the rally, but still not back to exuberant yet. However, positioning remains on the lighter side. With quarter-end rebalancing coming next week, the makret could surprise to the upside

GOLD/ENERGY

GOLD/ENERGY IS NOW RESTING ON THE 15 YHEAR UP TREND, AS LONG AS GOLD DECLIN IN 5 WAVES DOWN SO ANTICEPATE 3 WAVES UP SO REBOUND FROM THIS UPTREND WILL OCCURE ,BUT THEN MOST LIKELY AFTER REBOUND GOLDWILL BREAKDOWN THE UPTREND ACCORDING TO EWP 5-3-5 ZIGZAG PATTERN

2022-03-24

GLOBAL GDP

Goldman Sachs has significantly lowered its global GDP forecast for 2022

CONSUMER CONFIDENCE

Consumer confidence is falling of a cliff

2022-03-23

CPI COMPONENTS RISING FASTER 1% M-O-M

Nearly half of all CPI components are now rising faster than 1% month-over-month

2022-03-22

HIGH YIELD CORP vs EQUITIES

High Yield is usually a good indicator for risk on/risk off and moves in tandem with equities. In fact, it often leads the move.

We have interesting divergence now though between HYG (in blue) and the SPX

2022-03-21

CYCLE INDICATOR

The Morgan Stanley's US cycle indicator suggests similarities to 2004-05

2022-03-19

MARKET CYCLE

There is always a market cycle - you can see it playing out in factor performance since March 2020. Last week we told investors that we’re heading into Phase 4 - the Growth phase. Value leadership will fade with the coming EPS downgrade cycle ahead as the world slows

2022-03-18

SENTIMENT

The Fear & Greed Index stands at 26, signaling fear in the US stock market

US DOLLAR

US DOLLAR SINCE ITS REBOUND WALK IN UP SLOPING CHANNEL BUT LATELY REACHED THE UPPER TRENDLINE OF THE CHANNEL AND FORMED A SMMAL DOUBLE TOP, STILL NOT A VALID ONE YET BUT IT IS VERY STRANGE THAT DESPITE FED HAWWKISH US DOLLAR AND 10Y YIELDS, ESPECIALLY DOLLAR HAS BEEN FALLING FAST

MAY BE INVESTORS EXPECTED RATE HIKE 50 BPS

ACCORDIND TO FOMC SITE MORE THAN 50% WERE EXPECTED FED WILL HIKE RATE 50 BPS

2022-03-17

2022-03-16

2022-03-15

S&P 500

S&P 500 HAS BROKEN DOWN THE MA 200 AT4465 AFTER FORMED A DISTNICT HEAD AND SHOULDERS TOP ,THE PATTERN HAS COMPLETED BELOW 4200AND SHOULD CONTINUE DOWN TO ACHIEVE ITS TARGET AT 3600, BUT CLOSING ABOVE 4600 ITS THE BEGINNING OF THE FALUIRE OF THE HEAD AND SHOULDERS PATTERN AND COMPLETE WHEN PRICES CLOSE AOVE THE HEAD AT 4800

Subscribe to:

Comments (Atom)

IN THE NAME OF ALLAH THE MOST GRACIOUS THE MOST MERCIFUL

IN THE NAME OF ALLAH THE MOST GRACIOUS THE MOST MERCIFUL