AFTER THE LAST STOCK MARKTE‘S SELLOFF , MANY OF THE MAIN STREAM EXPERTS GAVE US A WIDESPREAD COMMENTARIES , SUCH AS , INVESTORS HAVE FEARS OF FAST PACE OF INFLATION, INTEREST RATE HIKES , THOUGH,THESE INFORMATIONS WERE KNOWN BEFORE , AS WELL AS THIS, EVERY ONE KNOWS THAT INCREASES EXPECTRED IN BOTH WAGES AND INFLATION IN 2018 , AND POSSIBLY 2019 ARE TOO SMALL TO TRIGGER A BIG REACTION FROM CENTRAL BANK.... SO WAT‘S NEW ?!!! NOTHIN

BUT ITS ABSURD OR CONVENTIONAL JUSTIFFICATION

IT IS STRANGE THAT GLOBAL STOCK MARKETS IGNORED , AN IMPORTANT ECONOMIC NEWS , SUCH GROWING THE US TRADE DEFICIT IN NOVEMBER ROSE TO ITS LARGEST IMBLANCE IN NEARLY SIX YEARS , YET THE STOCK MARKET HAS CONTINUED TO REGISTER ONE RECORD HAIGH AFTER ANOTHER.

DO YO BELIEVE THAT THE ECONOMY ACUALLY LEADS THE FINANCIAL MARKETS OR ؟INTEREST RATES

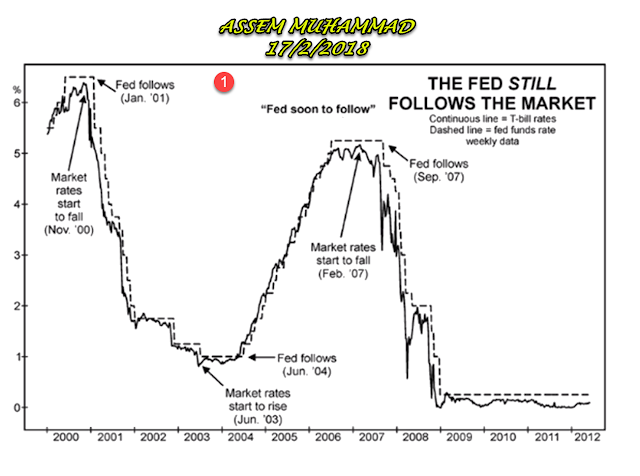

OKAY , GOING BACK AS FAR AS OCTOBER 1929 TO KNOW HOW THE STOCK MARKETS HAD PREDICTED THE GREAT DEPRESSION A FEW MONTHS BEFORE IT HAPPEND , THE CHARTS ABOVE SHOW, HOW THE STOCK MARKETS LEADS ON RATES NOT THE FED

I‘MA LEANING TO THAT THE GLOBAL STOCK MARKET‘S SELLOFF DUE TO , INVESTORS ARE FEELING PRETTY GOOD ABOUT THEMSELVES AND THEY HAVE TOO MUCH CONFIDENCE, BECAUSE OF THE STRONG PERFORMANCE OF THE US ECONOMY AND THE GLOBAL ECONOMIC GROWTH GENERALLY , WE SHOULD REMEMBER THIS ADAGE "WEN COMPLACENCY REIGNS WE ALL GET WET" , CONFIDENCE IS GOOD TO A POINT BUT WEN ITS EXTREME IT BECOMES A CONTRARIAN INDICTOR , AND MAYBE - IN SOME CASES - LEADS TO MASS HYSTERIA IN SELLING

EVENTUALLY

TO THOSE EXPERTS Y‘ALL , PLZ LET THE SUPERFICIAL COMMENTARIES A SIDE AND SEARCH FOR REASONABLE REASONS TO DEMONSTRATE THE REAL FACTORS FOR RISING AND FALLING OF STOCK MARKTES